Straight Talk: How I Paid for Braces Without Breaking the Bank

So, you need braces—but your wallet’s screaming? I’ve been there. Orthodontics aren’t cheap, and surprise costs can wreck your budget. Instead of stressing, I built a smarter money plan. No wild investments, no get-rich-quick schemes—just clear steps, real choices, and lessons learned the hard way. This is how smart financial planning turns a costly health move into something totally doable. It’s not about having more money; it’s about using what you have with purpose. I didn’t win the lottery or inherit a fortune. I simply treated my orthodontic journey like a financial project—one that required research, patience, and discipline. And in the end, I walked away not just with a straighter smile, but with stronger financial habits that continue to serve me every day.

The Shocking First Quote: Why Orthodontics Hit Differently

When I first received the quote for braces, I felt like I’d been punched in the gut. The number on the page—over $6,000—wasn’t just high; it felt disproportionate to everything I knew about dental care. After all, I already had insurance, brushed twice a day, and visited the dentist regularly. Why was this extra step so expensive? What I didn’t realize at the time was that orthodontics occupy a unique space in healthcare: they offer both medical and cosmetic benefits, but are rarely covered in full. Most dental plans categorize braces as a “major” or “limited” benefit, often capping coverage at $1,000 to $1,500, even for adults with clear functional needs like misalignment or bite issues.

This gap between expectation and reality is where financial stress begins. I assumed my insurance would handle the bulk, just like it did for fillings or cleanings. But orthodontic treatment operates differently. It’s long-term, involves specialized care, and requires ongoing adjustments over 18 to 36 months. The total cost reflects not just the hardware—brackets, wires, retainers—but also the expertise and time of the orthodontist. What shocked me most wasn’t the sticker price, but the lack of transparency around it. Some clinics quoted all-in prices; others itemized fees for consultations, X-rays, emergency visits, and even the final retainer. Without careful comparison, it’s easy to underestimate the true cost by hundreds—or even thousands—of dollars.

What changed my mindset was reframing braces from an unexpected expense to a planned investment. Instead of reacting emotionally to the number, I started asking questions: What’s included in the quote? Are there payment options? Can I appeal my insurance? This shift—from panic to planning—was the first step toward regaining control. I began treating the process like any major purchase: researching providers, comparing plans, and evaluating long-term value. Once I accepted that braces were not an emergency but a deliberate health decision, I could approach the cost strategically, not desperately. That mental shift made all the difference.

Mapping the Timeline: Aligning Treatment with Cash Flow

One of the biggest mistakes I almost made was focusing only on the total cost, not the timing. I initially thought I needed to come up with thousands of dollars all at once. That pressure felt overwhelming—until I learned that treatment duration could actually work in my favor. Braces typically last between one and three years, which means the financial burden doesn’t have to hit all at once. By aligning my treatment timeline with my income cycles, I turned a daunting lump sum into manageable monthly obligations.

I sat down with my calendar and pay schedule. I knew I received a modest annual bonus in December and had slightly higher income during the summer months due to seasonal work. I also tracked when my utility bills were lowest and when discretionary spending naturally dipped—like after the holidays. Using this data, I created a 24-month savings and payment plan that matched my real-life cash flow. Instead of forcing $500 a month during tight months, I averaged $350 across the year, increasing contributions during high-income periods and easing up when expenses rose. This flexibility prevented burnout and kept me consistent.

I also negotiated with the orthodontist’s office to delay the start of treatment by a few months. This gave me time to build a cushion without feeling rushed. When I did begin, I opted for a payment plan that allowed me to pay in installments tied to my progress—some due at the start, some midway, and the final portion after removal. This structure reduced the upfront burden and gave me breathing room. The key insight was that time is an asset when used wisely. Stretching payments over the treatment period didn’t increase the total cost, as long as I avoided interest-bearing loans. By syncing my financial rhythm with my treatment timeline, I transformed a financial obstacle into a predictable, manageable process.

The Savings Hack Nobody Talks About: Micro-Funding for Big Health Goals

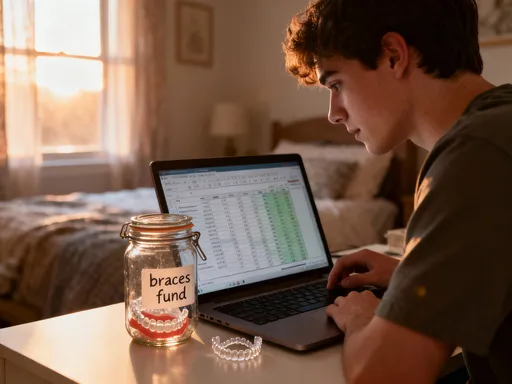

When I first started saving for braces, I made the classic mistake of waiting for big wins—tax refunds, bonuses, or windfalls. But life doesn’t always deliver lump sums, and relying on them is risky. The real breakthrough came when I shifted to micro-funding: saving small, consistent amounts with intention. I opened a separate high-yield savings account labeled “Braces Fund” and set up automatic transfers of $50 every payday. It didn’t feel like much at first—$100 a month seemed laughable against a $6,000 goal—but over time, it added up.

What made this approach powerful wasn’t the amount, but the consistency. By automating the transfers, I removed the temptation to skip a month. I also started redirecting small savings from daily choices. For example, I switched from premium coffee to brewing at home, saving about $120 a month. I canceled one subscription service I rarely used, freeing up another $15. I used cash-back apps for grocery shopping and put the rewards directly into the braces fund. These micro-savings weren’t about deprivation—they were about redirecting money I was already spending toward a higher priority.

Within six months, I had saved over $1,200—enough to cover the initial down payment and reduce the amount I’d need to finance. More importantly, the habit of saving became automatic. I began to see every dollar saved not as a sacrifice, but as a vote for my future self. This mindset shift was crucial. Instead of feeling like I was “giving up” things, I felt like I was building something valuable. Micro-funding taught me that financial progress doesn’t require dramatic actions—just small, repeated decisions aligned with a clear goal. It’s one of the most underused tools in personal finance, especially for health-related expenses that feel too big to tackle.

Payment Plans vs. Personal Loans: What Actually Works

When I realized I couldn’t pay for braces in full, I explored financing options. The orthodontist’s office offered an in-house payment plan: “$199 a month for 36 months, no interest if paid on time.” It sounded simple, but I knew better than to accept the first offer. I dug deeper and compared three main options: in-house financing, personal loans from credit unions, and 0% intro APR credit cards. Each had pros and cons, and the wrong choice could cost me hundreds in hidden fees or damage my credit.

The in-house plan was convenient but inflexible. It required automatic payments and charged a steep late fee—$75—if I missed even one. There was no option to pay off early without penalty, and the contract locked me into that provider, even if I moved or wanted to switch. I also discovered that “no interest” only applied if I completed all payments. If I defaulted, the full interest—around 18%—would be retroactively applied. That was a risk I wasn’t willing to take.

Next, I looked at personal loans. I checked my local credit union and found a three-year loan at 7.5% APR with a fixed monthly payment. The total interest over the term would be about $480, but the loan was unsecured, portable, and allowed early repayment without penalty. More importantly, it wouldn’t affect my credit utilization ratio as much as a credit card would. This gave me more control and peace of mind.

Finally, I considered a 0% intro APR credit card. One major issuer offered 18 months of no interest on purchases. If I could pay off $5,000 within that window, I’d save all interest. But the risk was high—if I didn’t pay it off in time, the retroactive interest would kick in. Given my irregular income, I decided the risk outweighed the reward. In the end, I chose the credit union loan. It wasn’t the flashiest option, but it was the most reliable. I paired it with my savings to cover the down payment and stuck to the repayment schedule without stress. The lesson? Convenience often comes with hidden costs. Taking time to compare options can save you money and protect your financial health.

Insurance Gaps and Workarounds: Making the System Work for You

My dental insurance promised to cover “up to $1,500” for orthodontic treatment. That sounded helpful—until I read the fine print. The actual reimbursement was limited to 50% of covered services, and only after I met a $250 deductible. Even worse, the plan excluded certain procedures like X-rays and emergency adjustments. After submitting my first claim, I received a check for just $437. I was stunned. I had assumed “up to” meant I’d get close to the maximum, but the reality was far different.

Instead of accepting this, I decided to explore every possible workaround. I learned about Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs), which allow pre-tax dollars to be used for qualified medical expenses. My employer offered an FSA, so I enrolled and contributed $1,200 for the year, knowing I could use it for braces. This reduced my taxable income and gave me access to funds early in the year. I also checked if my plan allowed for a Health Savings Account (HSA), though I didn’t qualify because my health insurance wasn’t high-deductible.

Another strategy was appealing the initial claim decision. I gathered documentation from my orthodontist—medical necessity letters, treatment plans, and X-ray results—and submitted a formal appeal. It took six weeks, but I was able to increase my reimbursement by another $200. I also asked if my employer had a dependent care reimbursement program. While it didn’t apply to my situation, some parents have used these for children’s orthodontics.

The biggest win came from timing. I scheduled the bulk of my treatment to begin in January, right when my FSA reset. That allowed me to use the full annual contribution without losing unused funds. I also coordinated with my orthodontist to submit claims in phases, ensuring I maximized reimbursements over two calendar years. These moves weren’t flashy, but they saved me nearly $1,000 in out-of-pocket costs. The takeaway? Insurance is a tool, not a solution. You have to use it actively, not passively, to get the most value.

Side Hustles That Fund Health, Not Just Fun

I didn’t want to rely solely on savings and loans, so I looked for ways to earn extra income. I explored several side hustles, each with different time commitments and returns. Tutoring local students in math and English paid $30 an hour and fit well with my evenings. I also took on freelance writing jobs through a platform I’d used before, earning about $500 a month during peak periods. I sold gently used furniture and electronics online, clearing out clutter while making $700 over six months.

Not every side hustle was worth it. One gig—delivering groceries on weekends—burned me out. The pay wasn’t great after gas and wear on my car, and it left me too tired for my main job. I quit after two months. Another—making handmade crafts—was enjoyable but too time-consuming for the return. I learned that not all extra income is equal. The best side hustles were those that aligned with my skills, schedule, and energy levels.

I set a monthly earning target of $300 from side income and tracked it like a budget line. When I exceeded it, I put the surplus into the braces fund. When I fell short, I adjusted my spending elsewhere. This approach kept me balanced and prevented overwork. Most importantly, I reframed these efforts not as “side gigs” but as temporary investments in my health. That mindset helped me stay motivated, even on busy weeks. Earning extra money didn’t have to mean sacrificing well-being—it just required smart choices and clear boundaries.

The Real Win: Building Financial Confidence Through Health Spending

When I finally removed my braces, the mirror showed a straighter smile—but the real transformation was invisible. I had developed a new relationship with money. Paying for braces wasn’t just about fixing my teeth; it was about proving to myself that I could handle big financial challenges with calm and clarity. Every payment, every saved dollar, every decision to compare options reinforced a sense of control. I stopped seeing health expenses as unpredictable burdens and started viewing them as intentional investments in my long-term well-being.

This shift in mindset spilled over into other areas of my finances. I became more proactive about budgeting, more confident in negotiating bills, and more disciplined in saving for future goals. I started an emergency fund, reviewed my insurance annually, and began planning for retirement with greater seriousness. The skills I built during my braces journey—research, planning, patience—applied far beyond one dental project.

Looking back, I realize that financial confidence isn’t built in big moments. It’s built in the quiet, consistent choices: opening a savings account, reading the fine print, saying no to a convenience fee, or choosing a side hustle that respects your time. These small acts compound, just like interest. Paying for braces didn’t make me rich, but it made me financially stronger. And that, more than any straightened tooth, is the outcome I value most.