What Happens When Your Dream Trip Meets a Financial Curveball?

Let’s be real—planning a trip is exciting, but what if life throws a financial wrench in your travel dreams? I’ve been there. Market dips, unexpected bills, or just falling short—these can wreck your travel fund fast. That’s why building a smart, flexible strategy isn’t just helpful, it’s essential. This isn’t about risky bets or get-rich-quick schemes. It’s about protecting your goals while still moving forward, step by step. For many women juggling family, home, and personal well-being, travel represents more than escape—it’s renewal, connection, and a reward for years of quiet dedication. Yet when finances waver, dreams are often the first thing sacrificed. The good news? With thoughtful planning, emotional clarity, and practical safeguards, your dream trip doesn’t have to wait for perfect conditions. You can protect your vision, adapt to change, and arrive at your destination with peace of mind—not debt or regret.

The Hidden Risk in Dreaming Big: Why Travel Savings Are Vulnerable

For many, saving for travel begins with enthusiasm—a vision of cobblestone streets, mountain vistas, or quiet beaches. But over time, that excitement often fades as daily expenses take priority. The reason isn’t laziness or lack of discipline; it’s design. Most travel funds are created without structure, tucked into checking accounts where they blend with rent, groceries, and utility bills. Because they lack separation and protection, they become vulnerable to life’s inevitable surprises. A car repair, a child’s school trip, or a medical co-pay can quietly drain funds meant for a once-in-a-lifetime journey. What starts as a small withdrawal becomes a pattern, and soon the dream feels out of reach.

The emotional weight of this setback is often underestimated. Travel is not just leisure—it’s a source of inspiration, rest, and personal growth. When those plans dissolve due to financial fragility, the disappointment runs deep. Yet few treat travel savings with the same seriousness as retirement or college funds. There’s a subconscious belief that vacations are “extras,” not essentials. But for caregivers, mothers, and homemakers who pour energy into others, a break isn’t indulgence—it’s restoration. Recognizing this truth is the first step toward change. When you reframe travel as a necessary investment in well-being, you begin to protect it differently.

Another hidden risk lies in inflation and low interest rates. Money sitting in a standard savings account earns little to no return, losing value over time. Even if you save consistently, rising prices can erode your purchasing power, meaning your fund buys less than expected. This silent threat compounds over months and years, making destinations seem more expensive without any change in behavior. Without awareness, savers feel confused—“I did everything right, so why can’t I go?” The answer often lies not in effort, but in strategy. A travel fund that doesn’t grow is not truly saving; it’s storing. And storage alone won’t get you to your destination.

Building a Buffer: The Smart Way to Shield Your Trip Money

Just as you wouldn’t send a child to school without a backpack, you shouldn’t send your travel dreams into the world without protection. A buffer—a financial safety net—is what stands between consistent progress and sudden collapse. The most effective way to shield your travel fund is to separate it completely from everyday accounts. Open a dedicated savings account labeled clearly for your trip. This simple act creates psychological and practical boundaries. When money has a name and a purpose, it’s less likely to be spent impulsively.

But separation alone isn’t enough. Your travel fund needs a partner: an emergency fund. Without one, any surprise expense becomes a threat to your trip. Imagine setting aside $3,000 for a European getaway, only to face a $1,200 dental bill. Without backup savings, you’re forced to choose—health or vacation. Most will choose health, and rightly so. But that decision shouldn’t mean abandoning your dream. An emergency fund of three to six months’ worth of essential expenses ensures that unexpected costs don’t raid your travel savings. Think of it as mutual protection: the emergency fund guards your stability, and the travel fund guards your joy.

Choosing the right type of account matters, too. While traditional savings accounts offer safety, they often yield minimal returns. Consider a high-yield savings account instead—these are FDIC-insured, just as secure, but offer higher interest rates that help your money grow over time. Some online banks offer rates significantly above the national average, accelerating your progress without added risk. The goal isn’t aggressive growth; it’s preservation with gentle momentum. Every dollar earned in interest is a dollar closer to your destination, compounding quietly in the background.

Automation strengthens this system. Set up automatic transfers from your checking account to both your emergency and travel funds each payday. Even small amounts—$50 or $100—add up when they’re consistent. Automation removes the need for willpower and decision fatigue, making saving effortless. Over time, these disciplined habits become invisible yet powerful, like roots supporting a growing tree. The peace of mind that comes from knowing your funds are protected allows you to enjoy the journey of saving, not just the destination.

Diversify Your Savings Path: Don’t Put All Your Eggs in One Travel Basket

Putting all your travel savings into a single account might feel safe, but it limits potential and increases long-term risk. Just as a garden thrives with variety, your savings grow stronger when spread across multiple low-risk vehicles. Diversification isn’t about chasing high returns or entering volatile markets—it’s about balance. By allocating funds across different types of accounts, you protect against stagnation and create resilience in the face of economic shifts.

Start with a high-yield savings account as your foundation. This is where most of your contributions should go—accessible, secure, and steadily growing. Next, consider short-term certificates of deposit (CDs) for a portion of your fund. CDs lock your money for a set period—three, six, or twelve months—in exchange for a slightly higher interest rate. While less liquid, they’re ideal for money you won’t need immediately. By staggering CD terms, you create a “ladder” that matures at different times, giving you access to funds without penalty when the moment is right.

Another option is a conservative money market account. These are typically offered by banks or credit unions and often provide better yields than regular savings while maintaining liquidity. They’re not investments in stocks or bonds, so risk remains low. Together, these tools form a balanced trio: high-yield savings for flexibility, CDs for growth, and money markets for stability. Spreading your savings across two or three of these options smooths out performance fluctuations and reduces dependency on any single account.

Diversification also applies to timing. Instead of waiting to save the full amount before booking, consider making strategic deposits. For example, use a portion of your tax refund to secure a non-refundable deposit on a vacation rental. This creates commitment and locks in today’s prices, protecting you from future increases. At the same time, continue saving the remaining balance in your diversified accounts. This hybrid approach combines action with discipline, turning intention into progress. The key is to avoid putting all your financial hope in one place—whether it’s a single bank, a single month’s income, or a single source of funding.

When Life Interrupts: Real Strategies for Staying on Track

No plan survives contact with reality unchanged. Job shifts, family needs, or health issues can disrupt even the most carefully laid financial path. The difference between those who reach their goals and those who don’t isn’t perfection—it’s adaptability. A rigid savings plan breaks under pressure; a flexible one bends and recovers. Building adaptability into your travel fund from the start ensures that temporary setbacks don’t become permanent detours.

One powerful strategy is tiered contributions. Instead of committing to a fixed monthly amount, define three levels: aggressive, standard, and minimum. In good months, you contribute aggressively—$200 or more. In average months, you stick to your standard plan—say, $100. And in tight months, you contribute the minimum—$25 or even $10—to keep the habit alive. This approach honors your financial reality without abandoning your goal. The psychological benefit is significant: you maintain control and avoid the all-or-nothing thinking that leads to quitting.

Windfalls offer another opportunity to stay on track. Bonuses, tax refunds, cash gifts, or even the proceeds from selling unused items can be directed toward your travel fund. Rather than spending these unexpected gains on fleeting pleasures, use them to accelerate progress. For example, a $1,200 tax refund could cover a third of a $3,600 trip. This isn’t about deprivation—it’s about intentionality. You’re not denying yourself joy; you’re redirecting it toward something meaningful and lasting.

Regular check-ins are essential. Schedule a monthly or quarterly review of your savings progress, income changes, and life circumstances. Ask yourself: Is my timeline still realistic? Do I need to adjust my target amount? Has anything changed that affects my ability to save? These reflections keep your plan alive and responsive. If a pause is unavoidable—due to a job loss or family crisis—protect the balance you’ve built. Don’t withdraw funds unless absolutely necessary. Instead, freeze contributions temporarily and resume when possible. The money already saved is a victory; preserving it keeps the dream intact.

Timing the Trip: How to Choose the Right Moment Without Regret

Booking a trip is more than picking dates and flights—it’s a financial decision with emotional consequences. The right timing balances affordability, readiness, and peace of mind. Booking too early might stretch your budget and create stress; waiting too long could mean missing opportunities or losing motivation. The goal isn’t to find the absolute cheapest deal, but the moment when you can travel without financial anxiety.

Use clear indicators to assess readiness. First, are you consistently meeting your savings goals? If you’ve hit 80% of your target and are on track to finish, it’s a strong signal. Second, is your income stable? Frequent fluctuations make future planning difficult. Third, is your debt under control? High-interest debt can undermine travel enjoyment, as worries about repayment linger in the background. If these conditions are met, you’re likely ready. If not, consider adjusting your timeline or destination to match your current reality.

Seasonality and pricing matter, but not at the cost of security. Off-season travel often offers lower prices and fewer crowds, making it a smart choice for budget-conscious travelers. However, don’t let a flash sale pressure you into booking before you’re ready. A $300 discount means little if it forces you into debt or drains your emergency fund. True savings come from patience and preparation, not impulse. Wait for deals, but only act when your financial foundation is solid.

Consider the emotional timing, too. Are you physically and mentally prepared for travel? A trip meant to rejuvenate can become exhausting if taken during a period of burnout or family crisis. Choose a window when you can truly disconnect and absorb the experience. This might mean delaying a trip by a few months to ensure it delivers the renewal you seek. The best travel moments are not just about where you go, but how present you are when you arrive.

Mind Over Money: Staying Motivated Without Obsessing Over the Number

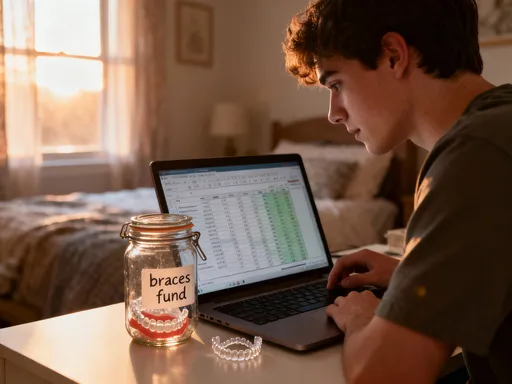

Saving for travel is as much a mental journey as a financial one. The balance in your account doesn’t just represent dollars—it reflects progress, discipline, and hope. But constantly checking the number can backfire, leading to frustration when growth feels slow. The key is to shift focus from the outcome to the process. Celebrate the behaviors that lead to success: setting up automatic transfers, skipping an unnecessary purchase, or redirecting a small windfall. These actions build confidence and reinforce long-term commitment.

Visual cues help maintain motivation. Set a photo of your destination as your phone wallpaper or desktop background. Create a simple chart to track progress and mark milestones. When you reach 25%, 50%, or 75% of your goal, acknowledge it—perhaps with a small, budget-friendly treat like a favorite coffee or a movie night at home. These celebrations reinforce positivity without derailing your plan. They remind you that the journey itself has value, not just the destination.

Comparison is a silent dream-killer. Social media often shows curated glimpses of others’ travels—beautiful, spontaneous, and seemingly effortless. But behind those images may be debt, stress, or years of unseen saving. Your path is yours alone. Focus on your progress, not someone else’s highlight reel. Remember why you’re saving: perhaps to reconnect with a sister, to show your children a new culture, or to walk through a city you’ve always dreamed of. These personal reasons anchor your motivation when numbers feel discouraging.

If motivation dips, revisit your purpose. Write down what this trip means to you. Is it rest? Adventure? Connection? Healing? Keeping that intention visible strengthens your resolve. Saving becomes less about sacrifice and more about preparation for something meaningful. Over time, this mindset builds financial resilience that extends beyond travel—it shapes how you approach all goals, big and small.

The Long Game: Turning One Trip into a Lifetime of Smarter Travel

Successfully funding and taking a trip is a milestone, but it shouldn’t be the end of the journey. It’s the beginning of a new financial habit—one rooted in intention, patience, and self-trust. Once you’ve achieved your goal, take time to reflect. What worked well? What was harder than expected? Did you adjust your plan along the way? Use these insights to refine your approach for the next adventure. This isn’t about chasing constant vacations; it’s about mastering the art of purposeful saving.

Consider launching a rolling travel fund. Instead of saving for one trip and stopping, keep the momentum going. After returning, set a new goal—perhaps smaller or larger, near or far. Redirect your monthly contributions to the next destination. This creates a cycle of anticipation and achievement, turning travel into a sustainable part of your life rather than a rare exception. Over time, you’ll find that the discipline you built doesn’t just fund trips—it improves your overall financial health.

Every time you protect your savings from an unexpected expense, choose long-term joy over short-term spending, or adjust your plan with grace, you strengthen your financial confidence. You prove to yourself that you can plan, adapt, and succeed. This quiet confidence radiates into other areas: budgeting, giving, home management, and personal goals. You begin to see money not as a source of stress, but as a tool for creating the life you want.

In the end, travel is not just about the places you see. It’s about who you become along the way. The woman who saves wisely, protects her dreams, and travels without guilt is not just a traveler—she’s a steward of her own well-being. And that journey, more than any destination, is worth every careful step.